sales tax calculator tucson az

Tucson in Arizona has a tax rate of 86 for 2023 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Property Taxes In Arizona Lexology

Name A - Z Sponsored Links.

. Multiply price by decimal. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax. Real property tax on median home. The price of the coffee maker is 70 and your state sales tax is 65.

Method to calculate New Tucson sales tax in 2022. To calculate the sales tax on your vehicle find the total sales tax fee for the city. The average cumulative sales tax rate in Pima County Arizona is 814 with a range that spans from 61 to 111.

The average sales tax rate in Arizona is 7695 The Sales tax rates may differ. Imposes a 400 transient rental tax on rent from persons renting accommodations for less than 30 consecutive days and a 1 per night charge per room rented but not as a part of the. The base level state sales tax rate in the state of Arizona is 56.

The minimum combined 2022 sales tax rate for South Tucson Arizona is. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Sales Tax State Local Sales Tax on Food.

Divide tax percentage by 100. What is the sales tax rate in Tucson Arizona. List price is 90 and tax percentage is 65.

Before-tax price sale tax rate and final or after-tax price. This is the total of state county and city sales tax rates. Tucson AZ Sales Tax Rate The current total local sales tax rate in Tucson AZ is 8700.

Sales tax in Tucson Arizona is currently 86. The current total local sales tax rate in South Tucson AZ is 11100. What is the sales tax rate in South Tucson Arizona.

Tucson Sales Tax Rates for 2023. Additional sales tax is then added on depending on location by local government. The December 2020 total local sales tax rate was also 8700.

The minimum is 56. 65 100 0065. The minimum combined 2022 sales tax rate for Tucson Arizona is 87.

The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Arizona has a 56 statewide sales tax rate but also. The December 2020 total local sales tax rate was also 11100.

This is the total of state county and city sales tax rates. This includes the rates on the state county city and special levels. Multiply the vehicle price after trade-in andor incentives by the sales.

Sales Tax Calculator in Tucson AZ. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tucson AZ.

Putting everything together the average.

Arizona Income Tax Calculator Smartasset

Tucson Arizona Sales Tax Calculator Us Icalculator

Sales Tax Rates In Tucson And Pima County Pima County Public Library

How To Calculate California Sales Tax 11 Steps With Pictures

Arizona Sales Tax Small Business Guide Truic

Arizona Sales Tax Rates By City County 2022

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Industrial Space For Rent Or Lease Tucson Commercial Real Estate Group Of Tucson

State And Local Taxes In Arizona Lexology

The Facts About Real Estate Tax In Arizona

5 Sales Tax Calculator Template

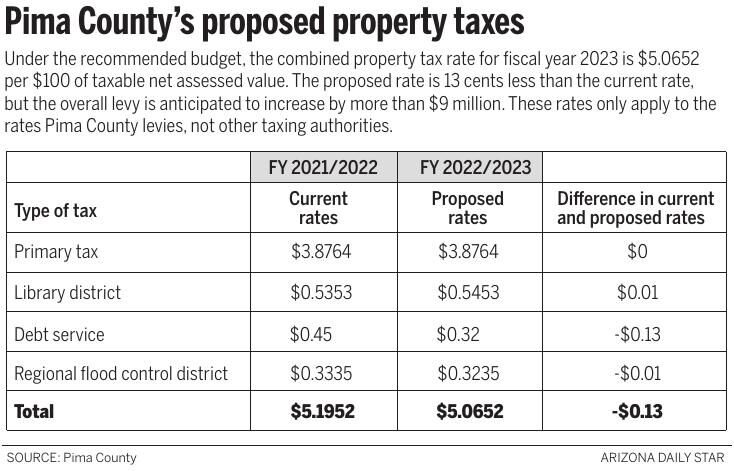

Pima County Property Tax Rate To Decrease Slightly In 2023 Fiscal Year

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)